Is the Market Going Up or Down?

The end of 2018 is nearly here and I wanted to take this opportunity to thank you for your continued trust and support. 2018 was another great year for me, both personally and professionally. My family is happy and healthy and my business has continued to grow.

As the year winds down, it is important to note we have had a rough final quarter in the markets so far (As of Dec 1). You may notice a decline in value on your year-end statements. I wanted to address this and assure you there is no reason to be concerned.

October in particular was one of the worst months for the markets since the global financial crisis in 2008. Why? There are a number of reasons; new tariffs (trade wars), BREXIT difficulties, rising interest rates, and fear of peak growth, just to name a few. Depending on who you listen too, the recent drop in the markets is either the start of a more significant downturn or a normal temporary correction before continued growth.

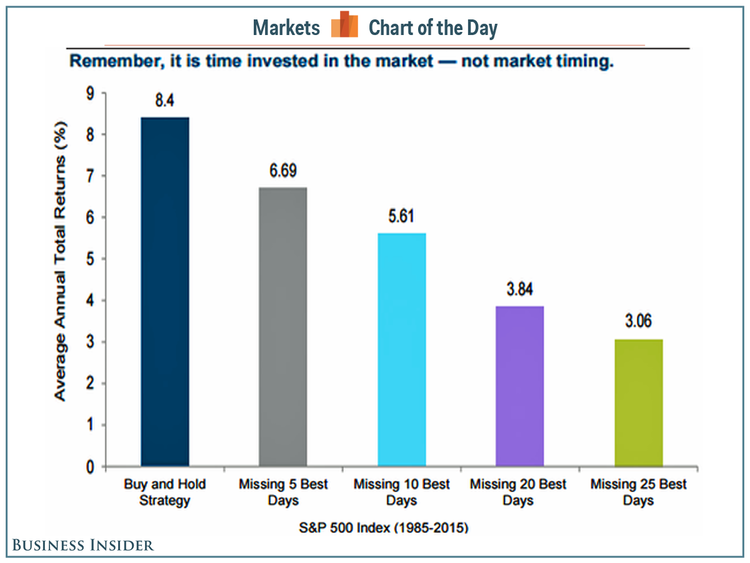

So, who is right? Which way are we going? Up or down? Well, I don't know, and to be honest no one truly does. They are all just educated guesses. One thing I have learned throughout my career is that it is a waste of time attempting to time the markets, and the best course of action is to stay invested and ride the waves. It is nearly impossible to consistently get out of the markets at the high and jump back in on the low. History has proven it is more dangerous to be out of the markets, than in the markets as illustrated in the chart below.

Staying invested is important, but I believe an important part of my job is preparing my clients for a downturn. I want to remind you that I have been doing exactly that. Not only have I been warning clients in meetings and discussions that a downturn is inevitable after such a sustained bull market, but I've also been positioning their portfolios for such an event. No bull market continues forever. In many of my conservative client's portfolios I've allocated more money to "Value" managers. These types of managers tend to provide more downside protection since they are buying things that they feel are undervalued, as opposed to "growth" managers who are buying stocks based on future potential. Value managers are also not afraid to hold cash if stocks are too expensive. As a result, I have noticed these portfolios have been very stable when the markets have taken downturns.

If you have any questions or concerns the most important thing to do is to call me so we can discuss your situation. There may be changes we can make, so you are more comfortable riding the waves!

Thank you again for your trust and support. I wish you all a very Merry Christmas and a Happy New Year!

Travis Dickinson, CFP